Shared Services Centre (SSC) Vs Outsourcing

- Is SSC equivalent to Outsourcing? To be exact, outsourced services are provided by an external company while SSC is provided by an internal organizational entity

- Internal customers of SSC have control in the cost and quality of the service they receive

SSC vs Treasury Centres

- SSC is actually centralizing operational & back-office routines such as making payments, collecting receivables, reconciliation, confirming & executing, reporting, Payroll etc.

- Treasury, on the other hand, manage treasury related matters and strategies such as maximizing deposit returns, loans and risk management using derivatives such as swaps, forwards for hedging

- Treasury also look at debt management by managing debt and establishing control

- Investment management such as using strategies to manage investment i;e: matching strategy, laddering or tranched cash flow allocations

- Interest and equity management

- SSCs are typically processing on behalf of operating entities, while treasury centres is working more on the importance of managing the working capital and strategies of the corporate

- SSCs do not need to be tax efficient as they do not process for their own books unlike treasury centres as they are booking transactions in their own books. For example Treasury centres moved their routine payment flows to SSC. SSC will initiate payments from accounts maintained in the treasury centre. These bookings are maintained in TC books instead of SSC as these accounts are held under TC entity name.

What are some considerations required to do to establish a SSC?

- Talent in the geographical area and labour costs

- Language and communication

- Financial infrastructure in that geographical area

- Ensure internally what operations are to be managed by SSC, what to consolidate and centralize with established best practices to track KPI

- To invest in training and recognize the importance of employees

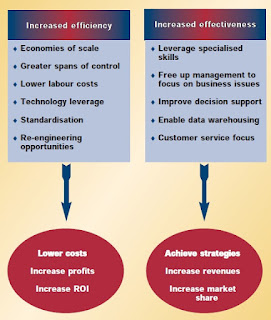

What are the benefits for having a SSC?

From: https://www.treasury-management.com/article/4/73/665/a-shared-service-centre-for-treasury-operations.html

No comments:

Post a Comment